In the ever-evolving landscape of cryptocurrency, securing your digital assets is paramount. One of the most effective ways to safeguard your investments is through the use of cold wallets. But what exactly are cold wallets, and how do they function to protect your cryptocurrency?

What Are Cold Wallets?

Cold wallets, also known as cold storage, refer to offline methods of storing cryptocurrency. Unlike hot wallets, which are connected to the internet and are more susceptible to hacking, cold wallets provide a secure environment for your digital assets. They can take various forms, including hardware wallets, paper wallets, and even air-gapped computers.

Types of Cold Wallets

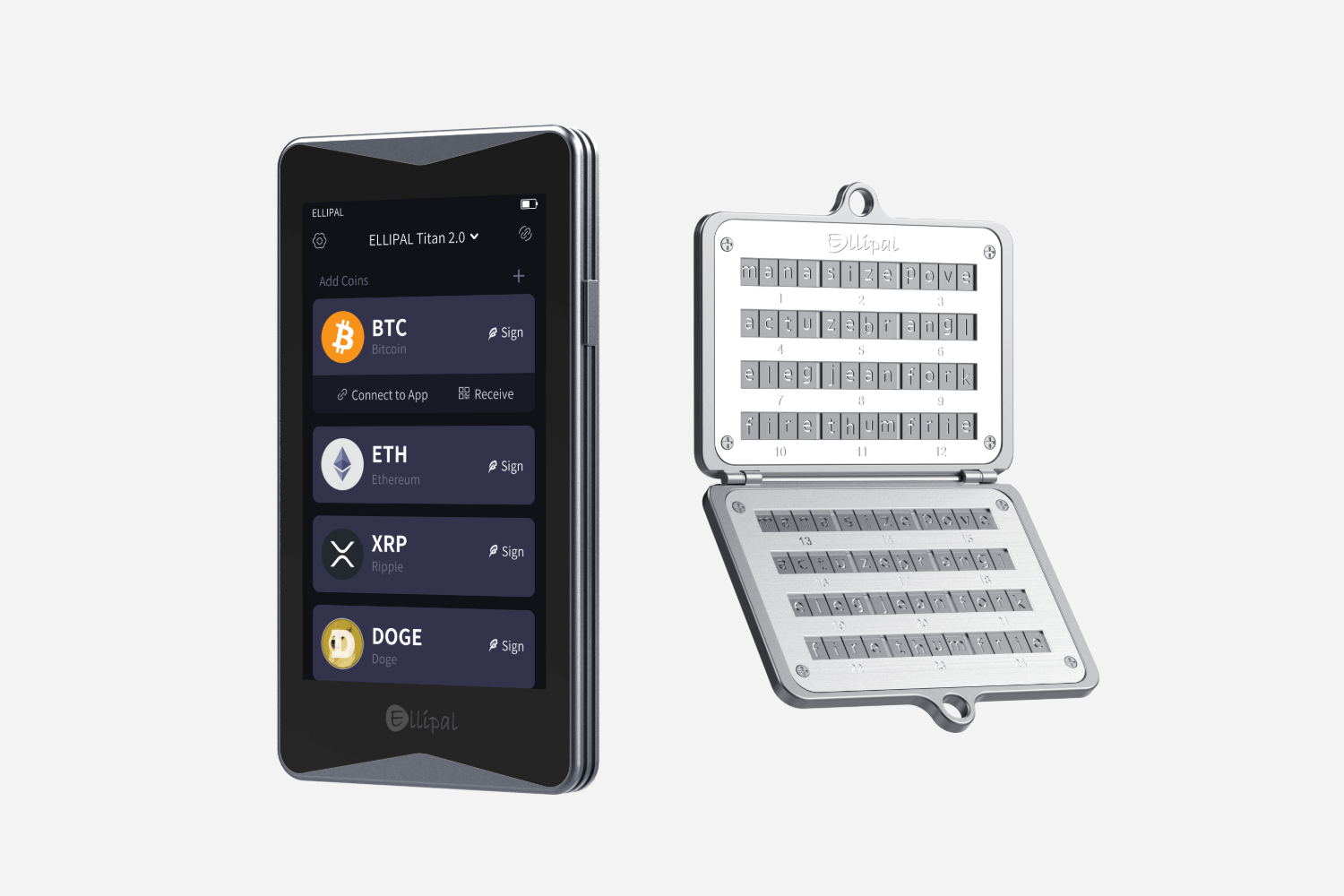

- Hardware Wallets: These are physical devices designed specifically for storing cryptocurrencies. They offer a high level of security and are user-friendly.

- Paper Wallets: This method involves printing your public and private keys on paper. While it is secure from online threats, it can be easily lost or damaged.

- Air-Gapped Computers: These are computers that have never been connected to the internet. They can be used to generate and store private keys securely.

Why Use Cold Wallets?

Using cold wallets is essential for anyone serious about protecting their cryptocurrency investments. Here are some compelling reasons:

- Enhanced Security: Cold wallets are not connected to the internet, making them immune to online hacking attempts.

- Control Over Assets: With cold wallets, you have full control over your private keys, reducing reliance on third-party services.

- Long-Term Storage: If you plan to hold your cryptocurrency for an extended period, cold wallets are ideal for long-term storage.

How to Choose the Right Cold Wallet

When selecting a cold wallet, consider the following factors:

- Security Features: Look for wallets that offer advanced security features, such as two-factor authentication and backup options.

- User Experience: Choose a wallet that is easy to use, especially if you are new to cryptocurrency.

- Compatibility: Ensure that the cold wallet you select is compatible with the cryptocurrencies you own.

Conclusion

In conclusion, understanding cold wallets is crucial for anyone looking to protect their cryptocurrency investments. By utilizing these secure storage methods, you can significantly reduce the risk of theft and loss. For those interested in a reliable hardware wallet, consider exploring the for a comprehensive solution to your cold storage needs.

As the cryptocurrency market continues to grow, ensuring the safety of your assets should remain a top priority. By leveraging cold wallets, you can enjoy peace of mind knowing that your investments are secure.